Shares of Amsterdam-based Nebius Group (NASDAQ: NBIS) surged more than 50% in premarket trading after the company announced a landmark multi-year partnership with Microsoft Corp. The deal, valued at $17.4 billion over five years, marks one of the largest commitments yet by a hyperscaler to an emerging AI infrastructure provider and positions Nebius as a formidable player in the race to supply advanced computing power for artificial intelligence.

Deal Overview

- Value & Scope: The agreement secures $17.4 billion in spending from Microsoft for GPU-driven AI computing capacity hosted in Nebius’s newly developed Vineland, New Jersey data center. The contract includes expansion provisions that could push the value to as much as $19.4 billion, depending on Microsoft’s demand.

- Infrastructure Supply: Nebius will provide high-performance clusters of GPUs, designed to support large-scale AI model training and inference workloads, effectively supplementing Microsoft’s own Azure infrastructure at a time when demand for compute far outpaces supply.

- Financing Model: The deal’s structure allows Nebius to leverage contract-backed cash flows to fund data center build-outs, while also relying on structured financing rather than heavy upfront equity dilution.

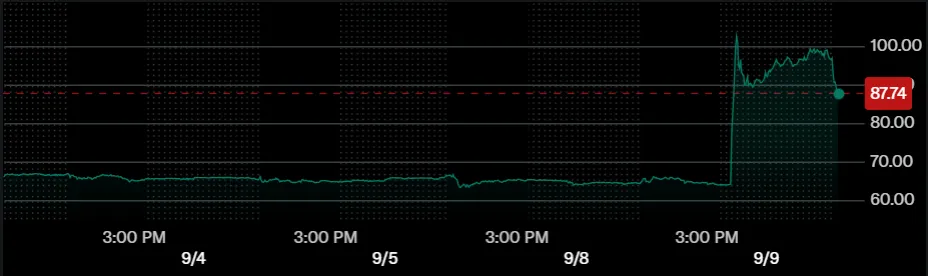

Market Reaction

- Stock Surge: Following the announcement, Nebius stock soared between 50% and 55%, briefly trading near $99 per share in early sessions. The rally added approximately $7.7 billion in market capitalization, nearly doubling Nebius’s valuation overnight.

- Broader AI Infrastructure Rally: Investor optimism spilled over to Nebius’s competitors, with shares of fellow “neocloud” provider CoreWeave rising about 6–7% as markets priced in growing demand for non-traditional compute providers.

- Analyst Response: Market analysts described the surge as a validation of Nebius’s long-term thesis as a “neocloud” company an agile alternative to traditional hyperscalers that provides specialized, modular AI compute capacity.

Strategic Implications

- Microsoft’s Motive: For Microsoft, the deal provides rapid access to large-scale AI compute capacity without the need to fully finance and build additional data centers internally. This is critical as its AI-driven products such as Copilot, Azure AI services, and OpenAI partnerships continue to accelerate demand.

- Industry Context: The agreement comes amid an ongoing global shortage of GPUs, with both tech giants and AI labs competing fiercely for scarce compute resources. Partnerships with firms like Nebius provide a lifeline for hyperscalers racing to scale AI infrastructure.

- Future Growth: Analysts believe this partnership opens the door for Nebius to secure additional contracts with other hyperscalers, independent AI labs, and enterprises seeking dedicated compute. The successful execution of this contract would significantly strengthen Nebius’s credibility and position it as a long-term strategic supplier.

The Rise of “Neocloud” Players

The Nebius-Microsoft deal highlights the rapid rise of a new category of infrastructure firms often referred to as “neoclouds”. Unlike traditional hyperscalers such as Amazon, Microsoft, and Google, neocloud providers focus on highly specialized GPU-driven compute clusters, tailored financing models, and modular expansions. Their agility makes them attractive partners for larger companies unable to meet skyrocketing AI demand through internal capacity alone.

Nebius’s success also reflects a shifting balance in the cloud industry: while the Big Three still dominate the sector, partnerships like this suggest hyperscalers are increasingly relying on specialist providers to sustain AI growth.

For Nebius, the deal represents both a validation of its business model and a transformative growth opportunity. Execution risks remain from supply chain constraints for GPUs to the need to scale infrastructure reliably at unprecedented speeds but the company now stands firmly at the center of the global AI infrastructure boom.

For Microsoft, the partnership underscores its strategy of securing compute capacity at all costs to maintain its leadership in AI. With Nebius now in the fold, the company has secured another critical channel for fueling its AI ecosystem.

In summary: Nebius’s soaring stock price is more than a short-term market reaction it’s a signal that the AI infrastructure landscape is entering a new phase, where nimble neocloud providers are becoming indispensable partners in the race to power the next generation of artificial intelligence.